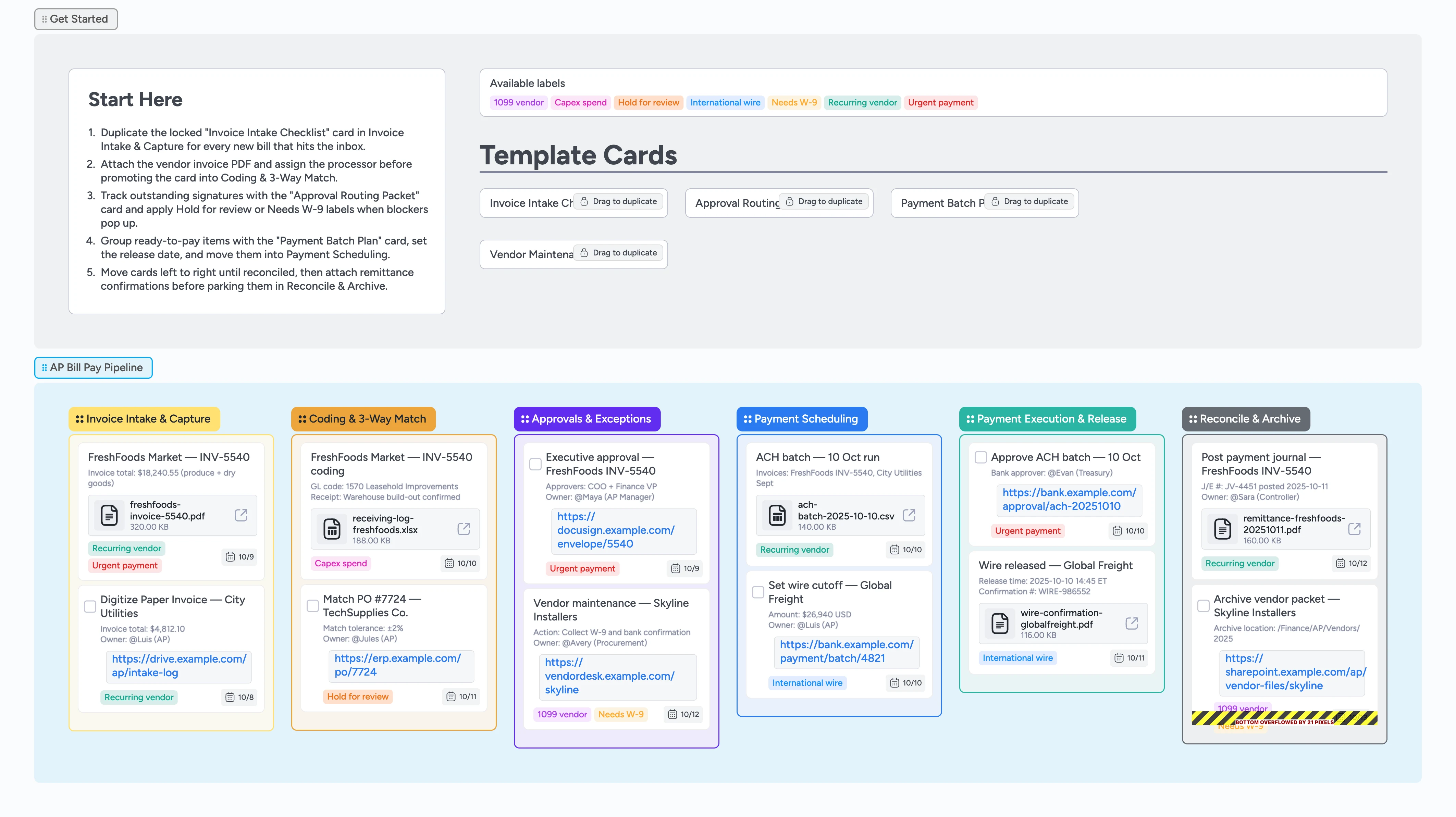

AP Bill Pay Pipeline Template

Never chase an approval again

Late vendor fees and duplicate payments creep in when intake inboxes, spreadsheets, and bank portals stay disconnected. Instaboard's real-time board turns every invoice into a single card the whole AP team can see, filter, and drag so status never hides in email. You duplicate the locked “Invoice Intake Checklist” card the moment a bill lands, assign the processor, and move that same card across six stages until it is reconciled. Labels like Urgent payment, Needs W-9, and International wire surface blockers instantly, while comments and @mentions keep approvers accountable on the canvas. By the time treasury opens the Payment Scheduling column, the Payment Batch Plan card already holds dates, amounts, and linked bank files ready for release.

- Standardize invoice intake, coding, approvals, and payments by duplicating checklist cards and dragging them through one board so intake never has to ping treasury asking if a bill was paid

- Highlight blockers by applying labels like Urgent payment, Needs W-9, and Hold for review to filter hot work

- Attach vendor docs, remittances, and bank proofs as you drag cards into Reconcile & Archive so auditors open one Instaboard card instead of three systems

- Give finance and treasury a shared checklist by co-editing Payment Batch Plan cards, @mentioning reviewers, and scheduling due date reminders before release

Start in Invoice Intake & Capture

Open the Get Started section, duplicate the locked "Invoice Intake Checklist" card, and park it in Invoice Intake & Capture for every bill that arrives. Fill Vendor name, Invoice #, Amount, GL code, Captured by, and Notes so the card is ready for review. Attach the invoice PDF or scan, assign the processor, and set the due date to the vendor terms. Apply Urgent payment when a bill needs fast handling or Recurring vendor for monthly utilities. Leave the card here until intake data is complete and matched to an owner.

Pro tip: Keep the intake card title as Vendor — Invoice # so the stage stays scannable.

Code the invoice and match documents

Drag the card into Coding & 3-Way Match once you have the source files. Open the card description, paste the PO or receiving highlights, and note variances so approvers see the full 3-way match history without digging through email. Add Instaboard checklist items for each variance and @mention the warehouse lead in the card comment thread so the conversation stays with the invoice. If documentation is missing, duplicate the "Vendor Maintenance Snapshot" to log outstanding forms. Attach ERP receipts or spreadsheets, apply Hold for review when a mismatch needs attention, and update the due date to when the match should finish so controllers see the deadline.

Route approvals and clear exceptions

Move the invoice into Approvals & Exceptions and duplicate "Approval Routing Packet" to document who must sign. Turn each approver into a checklist item, @mention them in card comments, and track statuses without leaving the board; they check their box in real time so AP immediately sees progress. Attach DocuSign envelopes or email threads so stakeholders have context. Apply Needs W-9 or 1099 vendor if compliance items are blocking approval. When every checklist item is complete, remove Hold for review and drag the card toward Payment Scheduling.

Pro tip: Use comments on the card to @mention approvers who still owe a response.

Schedule the payment with cash visibility

When approvals are complete, move the card to Payment Scheduling and duplicate "Payment Batch Plan". Record batch name, invoices included, release on, payment method, and contingency owner so treasury sees the plan. Attach the cash forecast or bank export file, paste cash-on-hand notes into the description, set a due date reminder 24 hours before release, and @mention treasury reviewers in the comments. Tag International wire when special handling is needed, then filter the stage by that label to isolate wires against bank cutoff coordination. Keep cards here until the bank queue is primed and ready to send.

Pro tip: Sort the stage by due date to sequence payments against cash forecasts.

Release funds and reconcile fast

After treasury submits the ACH or wire, drag the card into Payment Execution & Release and log confirmation numbers or timestamps right in the description so the bank proof sits beside the invoice PDF and approval thread. Attach the bank proof or positive pay export and check off the "Payment Batch Plan" task so the team sees it cleared. Once the journal entry posts, move the card into Reconcile & Archive, attach the remittance advice and any supporting PDFs directly to the card, and note the archive folder path in the description. Apply Capex spend or Recurring vendor filters before month-end to confirm nothing is open. Archive or duplicate the card once the final checklist item is done.

What’s inside

Six staged columns

Invoice Intake & Capture, Coding & 3-Way Match, Approvals & Exceptions, Payment Scheduling, Payment Execution & Release, and Reconcile & Archive keep the flow obvious, and dragging a single invoice card left to right stops duplicate work while exposing blockers in real time.

Locked AP micro-templates

"Invoice Intake Checklist", "Approval Routing Packet", "Payment Batch Plan", and "Vendor Maintenance Snapshot" stay locked so duplicating them enforces consistency, prevents accidental edits, and guarantees every invoice starts with the same checklist.

Risk-ready labels

Urgent payment, Recurring vendor, Hold for review, International wire, Needs W-9, 1099 vendor, and Capex spend make it easy to filter work.

Demo cards with real metadata

Sample cards include due dates, assignments in the description, links to ERPs and banks, and file attachments—duplicate one, tweak the fields, and your first invoice already has the context auditors expect.

Treasury alignment

Payment Scheduling and Payment Execution stages show release dates, confirmation numbers, and owners so treasury can @mention the controller in the Payment Batch Plan card and confirm release before bank cutoff.

Why this works

- Removes invoice blind spots by keeping every invoice as a filterable Instaboard card that intake, coding, and approvals drag through the same board

- Creates a repeatable checklist for treasury so payments release on time

- Keeps audit evidence attached to each bill for faster month-end close

- Surfaces blockers early with labels and exception notes before vendors escalate

FAQ

Can I handle recurring vendor bills with this board?

Yes. Duplicate the intake template for each cycle, tag it with Recurring vendor, duplicate last month's "Payment Batch Plan" card, update the release date and batch name, and drag it into Payment Scheduling so the full run is ready in seconds.

What if invoices live inside our ERP already?

Keep your ERP as the system of record, but orchestrate the workflow in Instaboard. Create one card per invoice, paste the ERP URL in the description, run approval checklists and @mention threads on that card, and attach the journal-entry PDF before you archive it so finance and treasury see the full trail without leaving the board.

How do we track vendors missing tax paperwork?

Use the Needs W-9 label on any invoice that cannot be paid yet and duplicate the "Vendor Maintenance Snapshot" card to log which forms and bank letters you still need.

How do we keep SWIFT deadlines visible?

Apply the International wire label, set a due date reminder inside the "Payment Batch Plan" card, and attach SWIFT confirmations in Payment Execution & Release so your compliance record and bank cutoff timing stay on the board.