Credit & Collections Pipeline Template

Keep credit and collections rhythm aligned

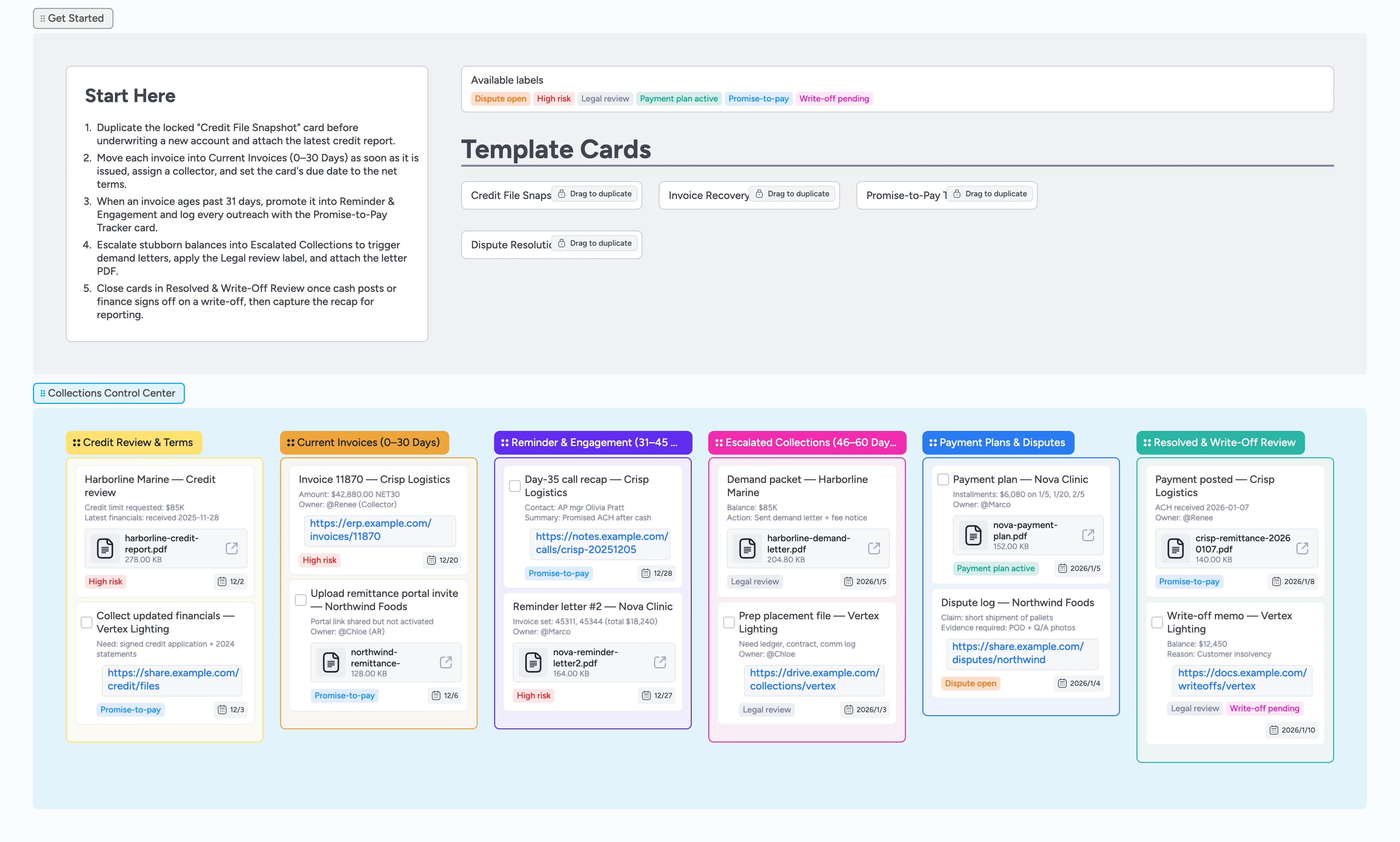

Give finance, credit, and collections the same real-time source of truth. This Instaboard combines a disciplined credit review lane, aging-based lists, and escalation-ready micro-templates so your team never improvises the next touch. Duplicate locked cards capture account snapshots, promise-to-pay notes, and dispute logs so everyone understands context before picking up the phone. Labels call out risk, payment plans, and legal reviews, while attachments keep demand letters, call recordings, and remittances one click away. Move cards left to right as balances age, and finish each cycle with a clean write-off memo or payment confirmation.

- See every invoice aging stage in one place

- Give collectors ready-to-duplicate outreach cards

- Escalate risky accounts with consistent documentation

- Close the loop on payment plans and write-offs

Start in Get Started

Open the Get Started section, duplicate the locked "Credit File Snapshot" card, and rename it for the account you are underwriting. Attach the latest credit bureau report or financial packet so the collector has context later. Assign the owner responsible for credit approval and apply the High risk label if any warning signs appear. Once the card is complete, move it into Credit Review & Terms and continue refining limits there.

Load fresh invoices into Current Invoices

Every time billing issues an invoice, drag a duplicate of the "Invoice Recovery Checklist" card into the Current Invoices (0–30 Days) list. Fill in the invoice number, amount outstanding, contact, and escalation trigger, then set the card due date to the net terms. Assign the collector who owns the relationship and add helpful links such as the ERP invoice or proof of delivery. Apply the High risk or Promise-to-pay label whenever their credit rating or payment intent changes.

Log reminders and promises

As soon as an invoice crosses day 31, move its card into Reminder & Engagement. Duplicate the "Promise-to-Pay Tracker" card inside the card body to record each call recap, promise date, and follow-up owner. Convert high-effort follow-ups into tasks so you can check them off after each call. Attach call recordings or reminder letters so the full outreach trail is preserved. Use the Promise-to-pay label to filter commitments that need daily checks.

Pro tip: Kick off reminders on day 25 so collectors stay ahead of the 31-day bucket.

Escalate with complete documentation

When a balance still lingers after the second reminder, slide it into Escalated Collections (46–60 Days). Apply the Legal review label, convert the card to a task, and list demand-letter to-dos so nothing is skipped. Attach the signed demand letter PDF plus any ledger exports or communication logs required by your agency. If you involve outside counsel, add them as watchers and tag the card with Write-off pending once legal approves the posture.

Resolve or write off cleanly

Move accounts with installments or disputes into Payment Plans & Disputes, duplicate the "Dispute Resolution Log" card, and outline evidence still required. Apply Payment plan active or Dispute open labels so finance can spot them instantly. When cash lands, drag the card to Resolved & Write-Off Review, attach the remittance confirmation, and add a recap of the actions taken. If finance approves a write-off instead, keep the card in the final stage with the Write-off pending label until the journal entry is recorded.

What’s inside

Credit review lane

Lock in underwriting tasks, attach credit files, and approve terms before an invoice ever lands.

Aging-based pipeline

Stages for 0–30, 31–45, Escalated, and Resolution keep every AR balance exactly where it belongs.

Micro-template toolkit

Duplicate Credit File Snapshot, Invoice Recovery Checklist, Promise-to-Pay Tracker, and Dispute Log cards to guide every touch.

Escalation labels

High risk, Legal review, Payment plan active, and Write-off pending tags power instant filtering.

Audit-ready attachments

Store demand letters, call recaps, signed payment plans, and remittance PDFs next to the work.

Why this works

- Connects policy to action with Start Here instructions tied to locked cards

- Surfaces risky balances fast through required labels and due dates

- Keeps audit evidence beside each escalation with attachments and notes

- Closes every loop by forcing a recap before archiving or writing off

FAQ

Can we skip the credit review lane if sales already approved terms?

Keep the first lane in place—duplicate the Credit File Snapshot card and add sales' approval so finance still owns final sign-off.

How do we track legal escalations or agency placements?

Move the card into Escalated Collections, apply the Legal review label, and attach the demand packet plus agency submission so the full chain of custody lives on the board.

Does this template support partial payments or payment plans?

Yes, use the Payment Plans & Disputes stage to log installment schedules, mark cards with Payment plan active, and set multiple due dates on subtasks.

What if a customer disputes the invoice?

Keep the card in Payment Plans & Disputes, duplicate the Dispute Resolution Log, and attach every proof document before moving it forward.