Expense Reimbursements Pipeline Template

Close reimbursements without chasing receipts

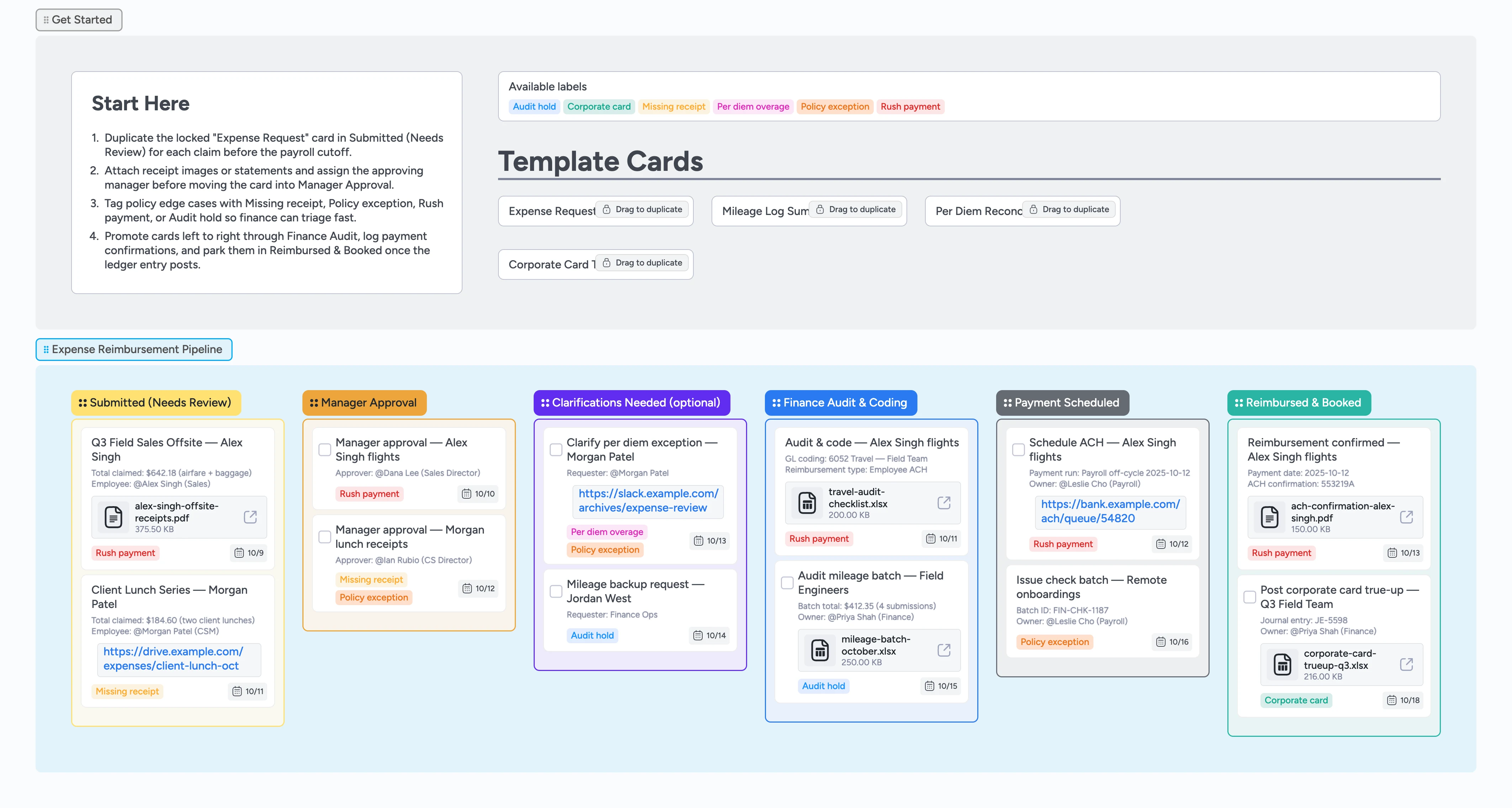

Instaboard keeps the entire reimbursement flow visible on one board so every claim moves from submission to payout without spreadsheet chases. Duplicate the locked "Expense Request" card the moment a claim arrives, drop it in Submitted (Needs Review), and attach every receipt or mileage log before it moves. Manager approvals, finance audit, and payment scheduling all stay on the same card so there is no double entry. That stops the weeks of email ping-pong where receipts get lost and status hides in inboxes. Labels like Missing receipt, Policy exception, and Rush payment make blockers filterable, while due dates and comments keep owners accountable until the ledger entry posts.

- Standardize submissions by duplicating locked cards and dragging them through six clearly named stages

- Surface blockers fast by applying Missing receipt, Policy exception, Rush payment, or Audit hold labels

- Attach receipts, mileage logs, and payment confirmations directly to each card for audit-ready trails

- Coordinate managers and finance by assigning due dates, @mentions, and comment threads that stay attached to each card on one shared board

Capture claims in Submitted (Needs Review)

Open the Get Started section, duplicate the locked "Expense Request" card, and drop it into Submitted (Needs Review) for every reimbursement. Fill Employee, Cost Center, Total Amount, and Notes so the manager sees the context instantly. Attach receipt PDFs or mileage spreadsheets, then assign the approving manager and set a due date tied to your policy cutoff. Apply Rush payment when payroll needs to fast-track a payout or Missing receipt if supporting docs are incomplete. Leave the card here until the submission has proof attached and an owner.

Route manager approvals quickly

Drag complete cards into Manager Approval and update the description with the checklist items the approver must confirm. Convert the card to a task so the manager's checkbox records the approval right on the board. Use comments to @mention the manager with clarifying questions and paste HR or expense system links so context lives on the card instead of in email. Apply Policy exception when the spend exceeds limits so finance can spot edge cases. Once the manager checks the task off, promote the card forward.

Resolve gaps in Clarifications Needed

If receipts, mileage logs, or per diem explanations are missing, park the card in Clarifications Needed (optional). Duplicate the "Per Diem Reconciliation" or "Mileage Log Summary" templates to collect structured info, set a fresh due date reminder, and @mention the employee inside the card thread so the request stays visible. Apply Per diem overage or Audit hold labels so finance can filter for follow-up during weekly reviews. Attach supporting documents as they arrive to keep the paper trail on the card and call out resolution notes in the comments. Move the claim along once the checklist is complete and the label can be cleared.

Audit and code the reimbursement

When approvals are in, slide the card into Finance Audit & Coding. Finance updates the description with GL coding, payment method, and exception notes so the ledger draft lives beside the receipts. Attach audit files like travel policy checklists or consolidated mileage workbooks directly to the card before closing the window. Apply Audit hold if something still needs review, and reply in the comments thread so the full conversation rides with the claim. Set the due date to the planned payment run to keep finance accountable.

Schedule payment and close the loop

Move the card into Payment Scheduled once finance is ready to pay and note the payment run or ACH batch in the description. Attach bank queue links or check logs, assign payroll or treasury, and keep Rush payment applied until funds go out. After money hits the employee, drag the card into Reimbursed & Booked, upload the payment confirmation or ledger export, and note the journal entry so month-end close is covered. Remove any exception labels and archive the card only after every attachment is in place. Filter the final column by label before close to confirm nothing is pending.

What’s inside

Six reimbursement stages

Submitted (Needs Review), Manager Approval, Clarifications Needed, Finance Audit & Coding, Payment Scheduled, and Reimbursed & Booked map the full journey so a single card rides from claim intake to ledger close.

Start Here instructions

The Start-Here card spells out how to duplicate templates, attach receipts, tag exceptions, and move cards left→right so new team members ramp quickly.

Duplicate-locked micro-templates

"Expense Request", "Mileage Log Summary", "Per Diem Reconciliation", and "Corporate Card True-up" stay locked so every claim starts with the same checklist.

Labels for policy triage

Rush payment, Missing receipt, Policy exception, Audit hold, Per diem overage, and Corporate card labels make it easy to filter approvals or escalations.

Demo cards with receipts

Sample cards already include due dates, policy notes, and attached PDFs or spreadsheets so your team can duplicate the pattern on their next real claim.

Why this works

- Keeps each reimbursement card visible from intake to ledger so no claim waits in email

- Anchors policy enforcement with duplicate-locked templates and required attachments

- Accelerates payouts by aligning managers, finance, and payroll on one timeline

- Delivers audit-ready history with labels, due dates, and receipts in the final column

FAQ

How do we handle mileage or per diem claims?

Duplicate the locked "Mileage Log Summary" or "Per Diem Reconciliation" cards, attach the supporting spreadsheet, and drag the card through the same stages so finance sees totals, dates, and approvals without a separate tracker.

Can this board support corporate card reimbursements?

Yes. Use the "Corporate Card True-up" template to log statement periods, personal spend, and reconciliation notes, then tag the card with Corporate card so finance can filter and settle it alongside cash reimbursements.

What if approvals live in Workday or another HRIS?

Paste the Workday request URL in the card description and keep the approval checklist and comments on Instaboard so it remains the source of truth for status, receipts, and policy notes even if the final approval click happens elsewhere.

How do we keep auditors happy at quarter-end?

Attach receipts, approval logs, and payment confirmations to the same card, leave the Audit hold label on anything missing, and run a filtered export of Reimbursed & Booked so audit pulls have attachments ready.