Fundraising Pipeline Template

Keep every investor touch visible

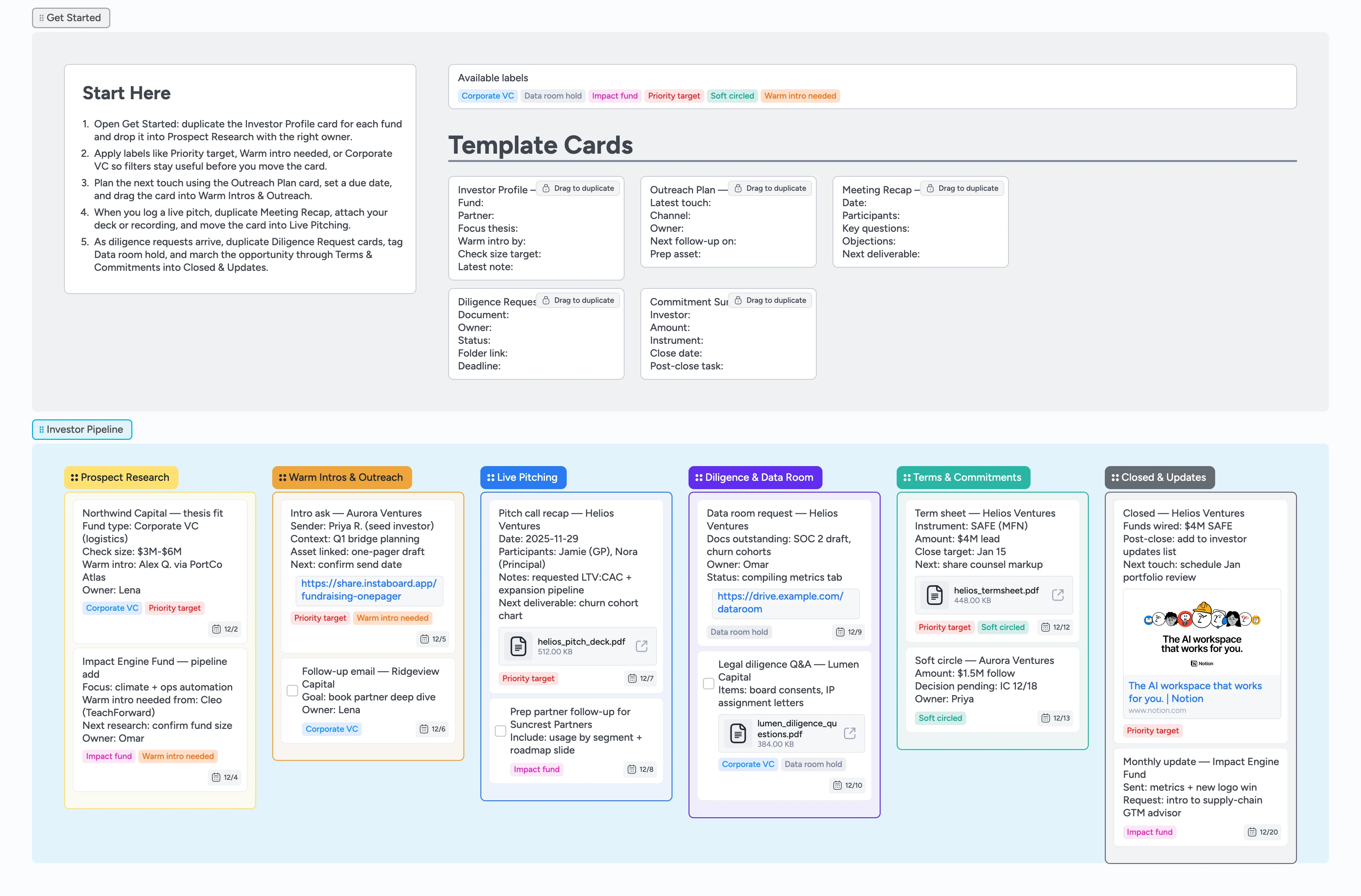

Stop duct-taping spreadsheets, docs, and inbox searches just to keep your raise straight. This Instaboard workspace packages research, warm intros, live pitches, diligence checklists, and soft circles into one flow your whole deal team can track. Duplicate the Investor Profile card from Start-Here, tag each fund by priority or type, and let due dates plus owners ride directly on the card. As you advance toward signatures, attach decks, data room folders, and term sheets so nothing waits on a DM or forwarded email.

- Centralize investor research, warm intros, and commitments

- Assign owners and due dates to every outreach or deliverable

- Attach decks, data room links, and legal files in context

- Use labels to filter priority targets, fund type, or blockers

Kick off Prospect Research

Open the Start-Here card in Get Started, duplicate the Investor Profile card, and drop each new fund into Prospect Research. Fill the Fund, Partner, and Warm intro fields, assign the owner, and set a due date for confirming fit. Apply labels like Priority target or Impact fund before you move on so filters stay clean. When the card is ready for outreach, drag it to Warm Intros & Outreach.

Drive warm intros and outreach

Use the Outreach Plan template whenever you request or send an intro. Convert it into a task, set the checkbox to remind yourself when the email actually goes out, and tag Warm intro needed if you’re still waiting on a champion. Attach your teaser or one-pager right on the card, then drop it into Warm Intros & Outreach so the team can nudge slow replies. As soon as a meeting lands, move the card to Live Pitching and duplicate a Meeting Recap in advance.

Capture every pitch and follow-up

During each call, fill in the Meeting Recap template with questions, objections, and the requested deliverable. Attach the deck or Loom recording for the investor that joined late, and turn the next action into a task with a due date tied to whoever owns the follow-up. Keep labels current so you can filter Live Pitching by Corporate VC or Impact fund when prepping weekly reviews. Once the recap is saved, drag the card to the right stage or back to Warm Intros if you need another champion.

Run diligence through close

As asks arrive, duplicate Diligence Request cards, tag them Data room hold, and store every file or folder link inside the card so counsel can help. Once a firm soft-circles or signs a term sheet, move the card to Terms & Commitments and summarize the instrument with a Commitment Summary card. Attach redlines or SAFE PDFs, set reminders for wiring deadlines, and shift closed investors into Closed & Updates so investor comms and reporting live in the same lane.

What’s inside

Start-Here playbook

Five bullets inside the Get Started section tell you exactly which micro-templates to duplicate, how to tag cards, and where to move them first.

Investor micro-templates

Reusable cards—Investor Profile, Outreach Plan, Meeting Recap, Diligence Request, and Commitment Summary—keep every touch logged the same way.

Six-stage pipeline

Prospect Research through Closed & Updates mirrors a real fundraising cadence so you can literally drag opportunities left to right as momentum builds.

Label primer

Tags like Priority target, Warm intro needed, Data room hold, Corporate VC, Impact fund, and Soft circled are preloaded for quick filtering.

Demo-rich cards

Sample cards show due dates, attachments, and file uploads so it’s obvious how to log decks, diligence asks, and signed paperwork.

Why this works

- Surfaces exactly who owes the next investor touch or deliverable

- Ties pitch recaps, decks, and diligence files to the card that needs them

- Uses color-coded labels to spotlight priority funds and blockers

- Moves opportunities through a stage order that mirrors modern fundraising

FAQ

Can I customize the stage names?

Yes. Rename any list (e.g., add a Bridge Round stage) and the Start-Here directions still apply—your micro-templates stay pinned in Get Started.

How do I track multiple rounds at once?

Duplicate the board per round or clone just the lists you need and tag cards Seed, Bridge, or Series A so you can filter inside a single workspace.

Where should I store pitch decks and diligence packets?

Attach every deck, model, or fake file directly to the card for that investor so teammates and counsel grab the latest version without hunting drives.

Can advisors or fractional CFOs collaborate here?

Invite them to the board, restrict editing if needed, and point them to the Diligence & Data Room stage so they can drop files or update owners.