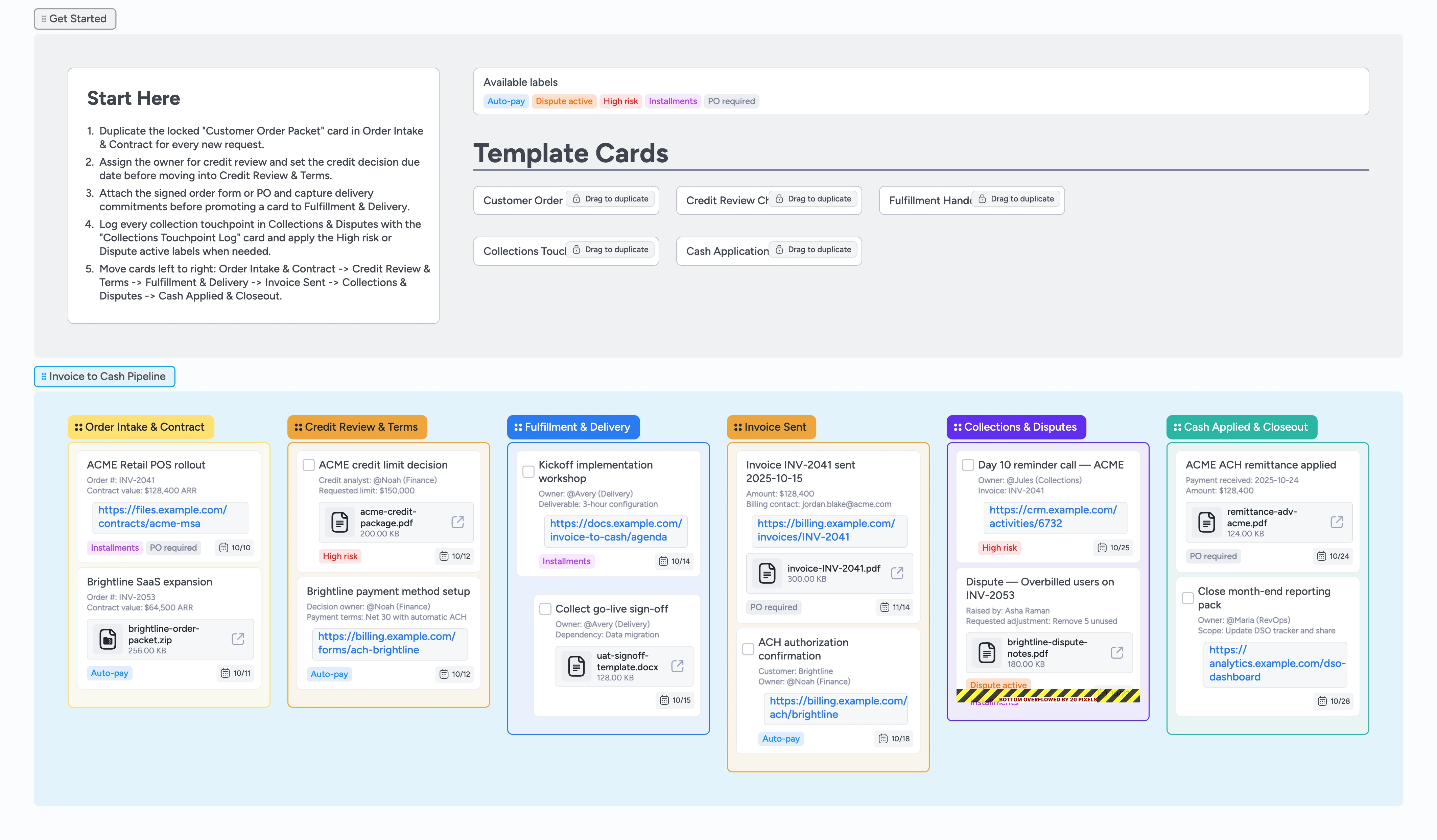

Invoice to Cash Pipeline Template

Keep cash flow predictable every billing cycle

Invoice to cash stalls when intake, credit, delivery, invoicing, and collections live in different tools; a shared spreadsheet still hides who owns the next move. This Instaboard board keeps every handoff visible on one canvas from the first order packet through applied cash. Duplicate template cards for new deals, assign the finance or delivery owner, attach contracts and remittances, and drag cards left to right as teams finish their part. Labels highlight risky accounts, auto-pay setups, and active disputes so nothing sneaks past due.

- Standardize order intake, credit, and fulfillment handoffs

- Track collections promises and disputes with live notes

- Attach contracts, invoices, and remittances to the right stage

- Pin due dates to each stage card so finance, sales, and delivery see blockers in real time

Kick off in Order Intake & Contract

Open the Order Intake & Contract section and duplicate the locked "Customer Order Packet" card for your new deal. Fill Customer, Order #, Contract value, Primary contact, and Next action so scope is obvious. Assign the sales or RevOps owner and set the credit decision due date before the handoff. Attach the signed order form or PO and apply the PO required or Installments label when relevant. Keep the card here until intake details are complete.

Run structured credit review

Move the card into Credit Review & Terms once intake is locked. Duplicate the "Credit Review Checklist" card to log analyst, requested limit, risk notes, and approval status. Assign the finance reviewer, set a follow-up date, and attach the credit package or bank references. Apply the High risk label if the account needs closer monitoring and Auto-pay when automatic drafts are approved. Advance after the decision is recorded and documentation is stored.

Coordinate fulfillment and delivery

Drag the work to Fulfillment & Delivery and duplicate the "Fulfillment Handoff Plan" card. Outline deliverable summary, owner, go-live target, dependencies, and required sign-off so nothing blocks invoicing. Break larger deployments into subtasks on the card checklist or link supporting cards, and attach agendas, runbooks, or UAT checklists. Assign the delivery lead and update due dates as milestones shift.

Invoice and schedule reminders

Move the card into Invoice Sent when fulfillment sign-off lands. Capture amount, billing contact, reminder cadence, and payment method either in the existing demo cards or your duplicated template. Attach the invoice PDF plus payment portal link so collections has everything at hand. Set a due date equal to the payment terms and use the card's reminder to ping the owner five days before it lapses. Leave the Auto-pay label on if ACH will clear automatically.

Stay on top of collections and disputes

Track every outreach in Collections & Disputes by duplicating the "Collections Touchpoint Log" card. Duplicate one log card per customer (or per call if volume is heavy), record call notes, promised payment dates, and escalation plans, then assign whoever owns the next follow-up. Apply High risk when cash is jeopardized and Dispute active when credits or adjustments are pending. Attach CRM transcripts, dispute documents, or recap emails so leadership sees context without digging.

Apply cash and close the loop

Once remittance arrives, drag the card to Cash Applied & Closeout and duplicate the "Cash Application Summary" card. Fill payment method, invoices cleared, variance notes, and follow-up owner so finance can finalize close. Attach the remittance advice or bank confirmation and set the month-end reporting due date. Clear risk labels once cash is reconciled and archive the card or duplicate it for recurring billing cycles.

What’s inside

Six left-to-right columns

Order Intake & Contract, Credit Review & Terms, Fulfillment & Delivery, Invoice Sent, Collections & Disputes, Cash Applied & Closeout keep work flowing as cards move left to right.

Duplicate-ready micro templates

"Customer Order Packet", "Credit Review Checklist", "Fulfillment Handoff Plan", "Collections Touchpoint Log", and "Cash Application Summary" cards stay locked so teams duplicate them instead of editing the master, guaranteeing consistent data capture.

Risk-focused labels

High risk, Auto-pay, Installments, Dispute active, and PO required labels flag the work that needs fast attention.

Demo cards with real metadata

Sample cards include due dates, tags, files, and notes so your team can mimic strong credit memos, invoices, and collection call logs.

Month-end close support

Cash Applied & Closeout cards capture remittance proof, variance notes, and reporting tasks to feed finance close checklists.

Why this works

- Exposes aging risks before invoices go late

- Connects finance, sales, and delivery around the same handoffs

- Captures payment evidence and remittance trails for audit readiness

- Shortens quote-to-cash by enforcing consistent follow-ups

FAQ

What if invoices originate in our ERP?

Keep your ERP as the system of record. Export the PDF or payment link, attach it to the Invoice Sent card, and move that card through Collections and Cash Applied while you log outreach and reconciliations.

How should we use the labels?

Apply High risk when an account needs escalated follow-up, Dispute active for open credits, PO required if procurement paperwork is missing, Installments when partial billing applies, and Auto-pay once ACH is authorized.

Can this handle subscription renewals?

Yes. Duplicate the template for each renewal cycle, keep delivery tasks scoped to expansion work, and spin up a fresh Collections Touchpoint Log card to track each renewal's follow-ups.