Accounting Client Onboarding Checklist Template

Get new accounting clients to first close without the back-and-forth

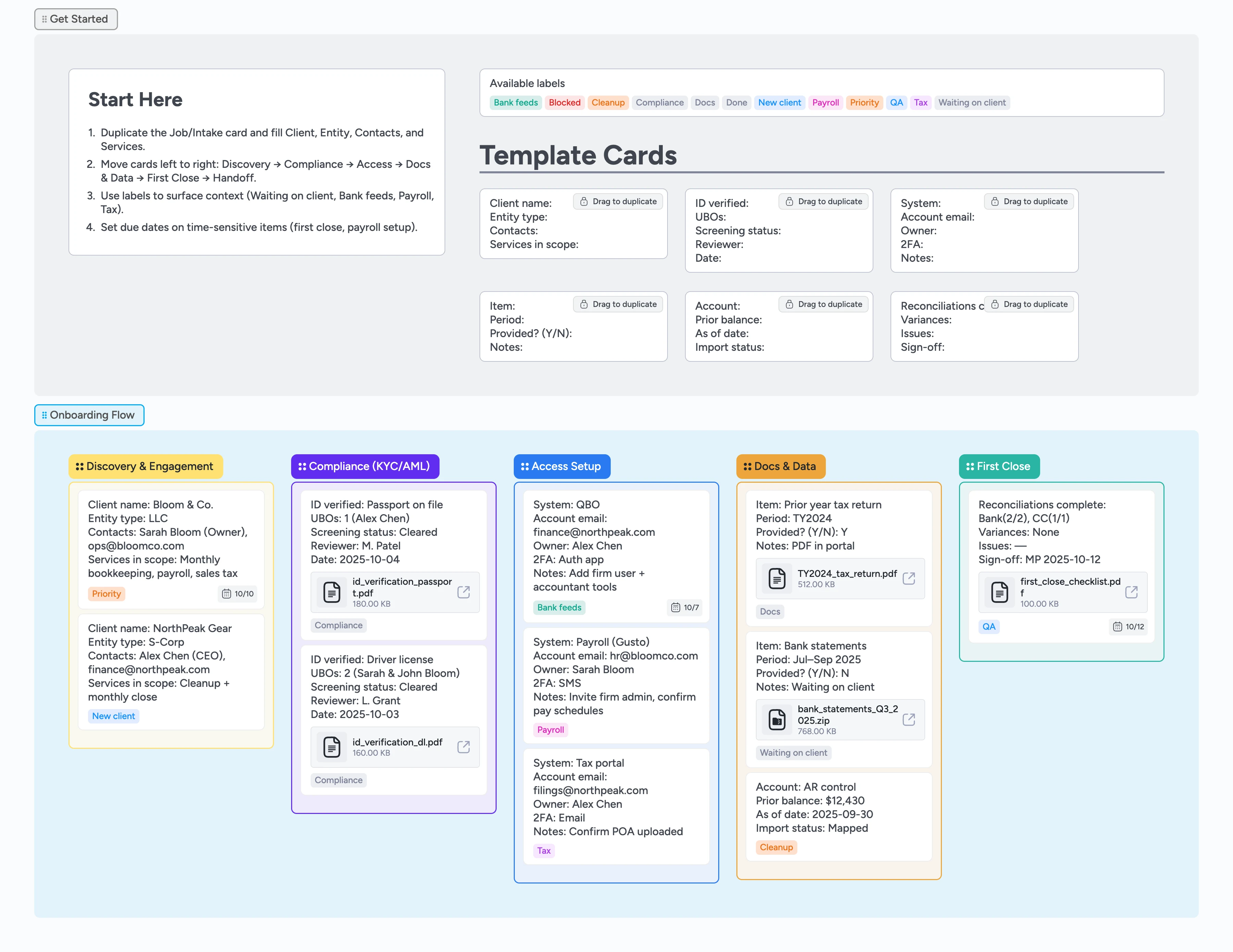

Turn engagement setup into a repeatable checklist. Track compliance documentation, chase access credentials, manage document requests, and confirm opening balances—all in one board. Move cards left-to-right as you complete intake, KYC/AML, system access, data collection, and first close. Works for monthly bookkeeping, cleanup engagements, and new tax clients.

- Track KYC/AML verification and keep audit evidence visible

- Chase bank feeds, payroll access, and tax portal credentials in one place

- Manage document requests without lost email threads

- Surface blockers before first close (missing statements, incomplete COA mapping)

- Reuse the same cards for monthly, cleanup, and tax onboarding

Duplicate Client Intake and fill engagement details

Fill Client name, Entity type, Contacts, and Services in scope. Keep one field per line. Set a due date if the engagement has a first-close deadline.

Complete KYC/AML and record verification

Duplicate the KYC/AML Record card. Note ID verification method, UBO count, screening status, reviewer name, and date. Store documents in your DMS; track completion status here.

Request access for each system

Duplicate Access Request cards for accounting software, bank feeds, payroll, and tax portals. Record account email, owner contact, 2FA method, and setup notes. Apply system labels (Bank feeds, Payroll, Tax).

Track document and data collection

Use Document Request cards for prior tax returns, bank statements, and source records. Add Opening Balances cards for COA mapping and import status. Tag cards Waiting on client when items aren't provided yet.

Move to First Close when data is complete

Once access is live and opening balances are mapped, move work to First Close. Use the First Close Review card to track reconciliation status, variances, and issues. Set a due date so the close stays visible.

Set the monthly cadence after first close

Note the standing schedule for monthly close, payroll runs, and sales-tax filings. When ready, duplicate the template cards for the next client to reuse your setup.

What’s inside

Five onboarding stages

Discovery & Engagement, Compliance (KYC/AML), Access Setup, Docs & Data, First Close. Move cards left-to-right as you complete each phase.

Reusable job cards

Client Intake, KYC/AML Record, Access Request (by system), Document Request, Opening Balances, First Close Review. Duplicate for each new engagement.

Labels for common blockers

Waiting on client, Bank feeds, Payroll, Tax, Compliance, Cleanup, QA. Surface handoffs and dependencies at a glance.

Due dates on time-sensitive items

Set deadlines for first close, payroll setup, or compliance review. Calendar view shows what's coming due across all active onboardings.

Why this works

- Surfaces blockers early so the first close stays on track

- Keeps compliance evidence and access status visible to the team

- Standardizes opening balance mapping to reduce rework

- Establishes a recurring cadence from day one

FAQ

Where do I store sensitive client documents?

Keep files in your document management system or client portal. Use this board to track request status, access setup, and handoffs so nothing falls through.

Can I use this for cleanup engagements?

Yes. Add the Cleanup label to affected cards and set due dates for interim milestones (imports, reconciliations). The same flow works for monthly and cleanup clients.

How do I adapt this to my firm's process?

Edit the template card fields once to match your intake form, compliance checklist, and close review steps. Then duplicate those cards for each new client. Labels and stages stay consistent across engagements.