Bookkeeping Client Onboarding Checklist Template

Turn bookkeeping onboarding into a repeatable flow

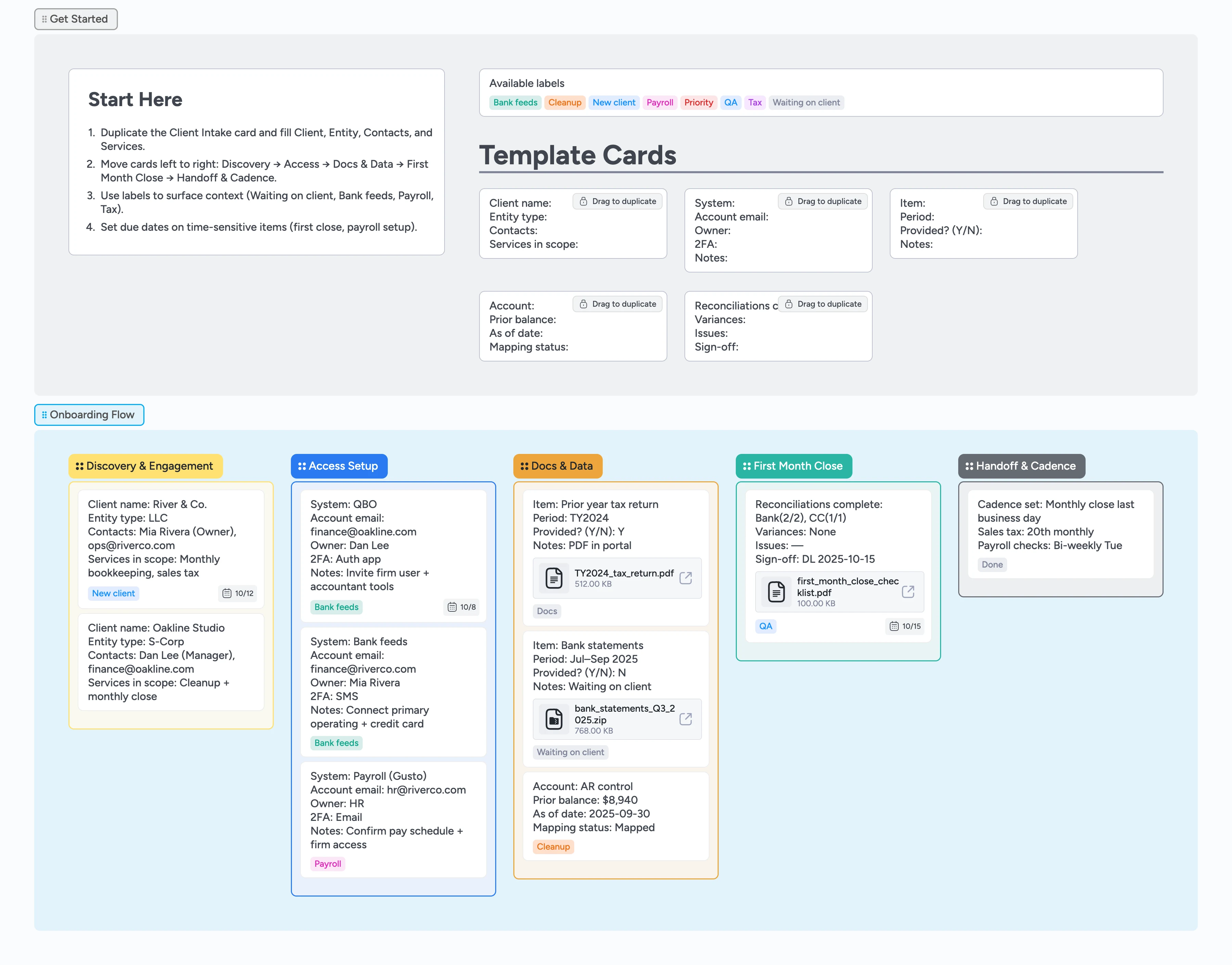

This checklist template helps bookkeepers standardize onboarding steps. Duplicate the intake card, request system access, collect documents, map opening balances, and complete a clean first‑month close—without juggling spreadsheets and email chains.

- Collect client facts once and reuse across engagements

- Chase bank feeds, payroll access, and tax portal credentials in one place

- Manage document requests without lost email threads

- Confirm opening balances and mapping before the first close

- Reuse the same cards for monthly, cleanup, and sales‑tax clients

Start here: duplicate Client Intake

You're in the right template to onboard a bookkeeping client. Begin in Get Started: drag the duplicate‑locked Client Intake card into Discovery & Engagement, then fill Client, Entity, Contacts, and Services exactly as labeled (one line per field). Assign the account owner so their avatar appears on the card, and set a due date for the first close so it stays visible everywhere. If this is a new relationship, add the New client label to make it easy to filter later.

Request system access in Access Setup

Head to Access Setup. Duplicate one Access Request per system (QBO, bank feeds, payroll, tax) and drop them into the list so each has its own card. For each card, record the account email, the real owner, and the 2FA method; assign the teammate who will chase it and set a follow‑up due date. Apply labels like Bank feeds, Payroll, or Tax so blockers are obvious at a glance.

Collect docs and opening balances

Open Docs & Data. Duplicate Document Request cards for prior returns, bank statements, and any source records you need, plus an Opening Balances card for COA mapping. As files arrive, attach PDFs or links directly to the matching card, and tag Waiting on client for anything still outstanding. Clear the tag and add a quick note when an item is complete so the lane tells the truth.

Move work into First Month Close

When access is live and balances are mapped, drag those cards into First Month Close. Duplicate the First Close Review card, assign it to the lead, and set the close due date. Use the review card to list the reconciliation checks (bank, cards, payroll, sales tax), known issues, and any edge cases you want to watch during the close.

Run the close in the board

Work the close from the board—not from memory. Check off items on the First Close Review card as you reconcile, attach variance notes/screenshots where needed, and tag QA on anything that needs a second look. Move fully reconciled cards toward Handoff & Cadence and collapse completed items to keep the current work in view.

Set your recurring cadence

In Handoff & Cadence, create three tiny checklist cards: Monthly Close, Sales‑Tax Filing, and Payroll Checks. Assign owners, set due dates that match your firm’s rhythm, and duplicate them each cycle so the next month starts ready. Add labels (Priority or Cleanup) when a client needs extra attention—future you will thank you.

What’s inside

Five onboarding stages

Discovery & Engagement, Access Setup, Docs & Data, First Month Close, Handoff & Cadence. Move cards left‑to‑right as you complete each step.

Reusable job cards

Client Intake, Access Request, Document Request, Opening Balances, First Close Review—dup‑lock cards you can copy for each engagement.

Labels that surface blockers

Waiting on client, Bank feeds, Payroll, Tax, Cleanup, QA. See handoffs and dependencies at a glance.

Due dates visible

Keep first‑month close and interim milestones on the card so dates stay visible.

Why this works

- Aligns intake, access, and docs so first‑month close stays on track

- Exposes handoffs and dependencies with filterable labels

- Reuses the same client cards to eliminate duplicate checklists

- Keeps reconciliation notes and variances attached to the work

FAQ

Where should we store source documents?

Store files in your document portal or DMS. Use this board to track requests, access setup, and close tasks so nothing is missed.

Can we use this for cleanups?

Yes. Add the Cleanup label to affected cards and add interim due dates for imports and reconciliations. The same flow works once access and balances are in place.

How do we adapt this to our practice?

Edit the template card field prompts to match your questionnaire and close steps, then duplicate them for every client.